BAT Releases 2024 Financial Report: Significant Growth in New Categories

On February 13, 2025, British American Tobacco (BAT) announced its fourth-quarter and full-year financial results for 2024. The report revealed that while traditional tobacco products faced challenges, the New Categories segment performed exceptionally well, becoming the primary driver of the company’s growth. This article provides a detailed analysis of BAT’s 2024 financial performance, market performance across product categories, and future strategic plans.

I. 2024 Financial Overview

1. Total Revenue and Profit

In 2024, BAT’s total revenue was £25.867 billion, a decrease of 5.2% compared to 2023. This decline was primarily due to a drop in sales of traditional tobacco products. However, the New Categories segment showed strong performance, with revenue reaching £3.551 billion, a year-on-year increase of 8.9%. Revenue from non-combustible products (including heated tobacco, modern oral, and traditional oral) totaled £4.674 billion, accounting for 17.5% of the group’s total revenue.

2. Vapour Business

The vapour business generated revenue of £1.765 billion, a decrease of 2.5% year-on-year. Despite this, BAT’s e-cigarette brand Vuse Alto maintained a dominant 50.2% market share in the US, demonstrating its strong competitiveness in the e-cigarette sector.

II. Market Performance by Product Category

1. New Categories

- Revenue: New Categories revenue was £3.432 billion, up 2.5% year-on-year. Excluding currency impacts, organic revenue grew by 8.9%.

- Market Share: New Categories accounted for 17.5% of total revenue, an increase of 10 percentage points from 2023.

- Consumer Base: The number of adult consumers for New Categories increased by 3.6 million, reaching 29.1 million.

2. Combustibles

- Revenue: Combustibles revenue was £20.685 billion, down 6.4% year-on-year. Excluding currency impacts, organic revenue remained flat (up 0.1%).

- Volume: Combustibles volume declined by 9.0%, mainly due to the divestment of operations in Russia and Belarus.

- Price/Mix: The price/mix effect for combustibles was +5.3%, partially offsetting the volume decline.

3. Vapour

- Revenue: Vapour revenue was £1.721 billion, down 5.1% year-on-year. Excluding currency impacts, organic revenue declined by 2.5%.

- Market Share: In the US, BAT maintained its leading position in the vapour market, although its market share decreased by 2.0 percentage points to 50.2%.

4. Heated Products (HP)

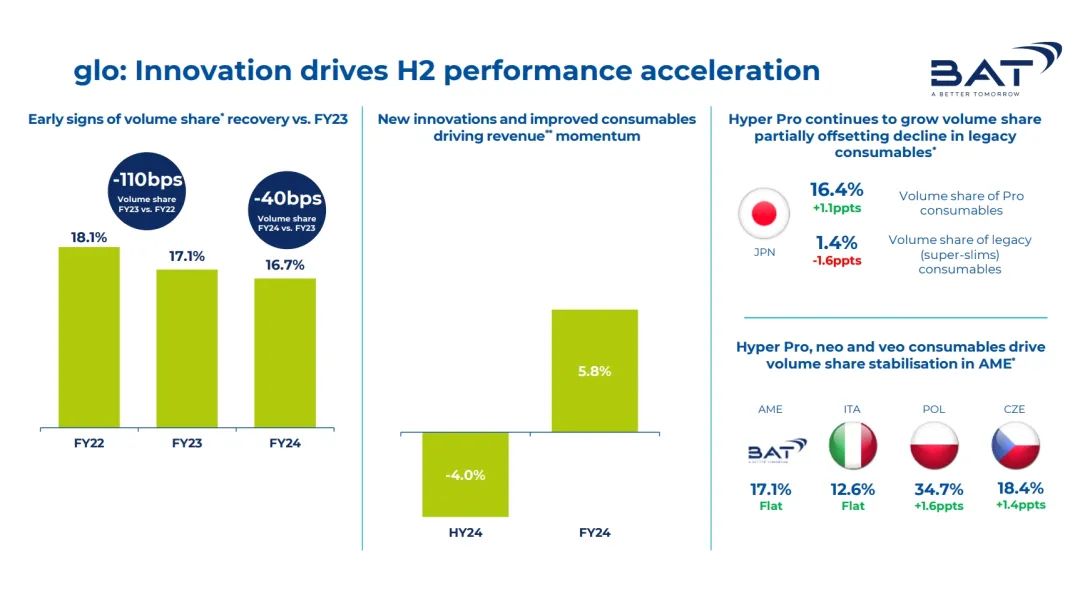

- Revenue: Heated products revenue was £921 million, down 7.6% year-on-year. Excluding currency impacts, organic revenue grew by 5.8%.

- Market Share: Heated products’ market share in key markets decreased by 40 basis points to 16.7%.

5. Modern Oral

- Revenue: Modern oral revenue was £790 million, up 46.6% year-on-year. Excluding currency impacts, organic revenue grew by 51.0%.

- Market Share: Modern oral was the fastest-growing category in New Categories, with the consumer base increasing by 54.2% to 7.4 million users.

6. Traditional Oral

- Revenue: Traditional oral revenue was £1.092 billion, down 6.0% year-on-year. Excluding currency impacts, organic revenue declined by 3.4%.

- Market Share: Traditional oral’s market share decreased by 40 basis points.

III. Regional Performance

1. US Market

- Revenue: US market revenue was £11.278 billion, down 6.0% year-on-year. Excluding currency impacts, organic revenue declined by 3.4%.

- Combustibles: Volume declined by 10.1%, mainly due to macroeconomic pressures and the impact of illicit disposable vapour products.

- New Categories: Vapour revenue declined by 0.8%, while modern oral revenue grew by 232%.

2. AME Market

- Revenue: AME market revenue was £9.241 billion, down 5.6% year-on-year. Excluding currency impacts, organic revenue grew by 4.9%.

- Combustibles: Revenue grew by 3.6%, driven by volume growth in Brazil, Turkey, and Mexico.

- New Categories: Modern oral revenue grew by 46.8%.

3. APMEA Market

- Revenue: APMEA market revenue was £5.348 billion, down 2.7% year-on-year. Excluding currency impacts, organic revenue grew by 5.4%.

- Combustibles: Revenue grew by 3.5%, driven by price increases in markets such as Pakistan, New Zealand, and Bangladesh.

- New Categories: Vapour revenue grew by 19.6%, and heated products revenue grew by 5.6%.

IV. Future Strategic Plans

BAT plans to launch several innovative products in 2025, including glo Hilo, Vuse Ultra, and VELO PLUS, to further drive the growth of the New Categories market. The company will continue to focus on the development and promotion of non-combustible products, aiming to generate 50% of revenue from non-combustible products by 2030.

Discover more from Ameca-mall

Subscribe to get the latest posts sent to your email.