Global Vape Market Shifts: U.S. Retains Top Spot, Germany Surpasses U.K. in China’s March 2025 E-cigarette Exports

U.S. Maintains Position as Top Importer of Chinese E-cigarettes

Despite looming uncertainties caused by heightened tariffs on Chinese goods announced by the United States in April 2025, the U.S. remained the largest importer of Chinese E-cigarettes in March, with an import value of $315 million USD. This figure accounts for over 36% of China’s total vape-related exports for the month.

American consumers’ affinity for disposable vapes and fruit flavored vape devices remains strong, driven by younger adult demographics and evolving perceptions of vapor products as a “healthier” alternative to traditional tobacco. However, with the U.S. government intensifying regulatory scrutiny and tax pressures, the sustainability of this market dominance may come into question in the months ahead.

Germany Surpasses U.K. Amid British Vape Ban Concerns

One of the most significant developments in March 2025 was Germany’s rise to the second spot among importers of Chinese vapor and E-cigarette products. Germany imported $75.46 million USD worth of goods — a 17.94% increase year-over-year — effectively surpassing the United Kingdom, which imported $73.87 million USD, down 14.87% from the previous year.

This change is largely attributed to the U.K.’s planned ban on disposable E-cigarettes, set to take effect on June 1, 2025. The upcoming legislation has already started to impact stockpiling and market behavior within the U.K., resulting in a cautious pullback in import volume and a strategic shift in supplier focus toward mainland Europe.

For China’s exporters, Germany’s steady economic climate and progressive stance on regulated nicotine products make it an increasingly attractive destination for fruit flavored vape and next-gen vapor devices.

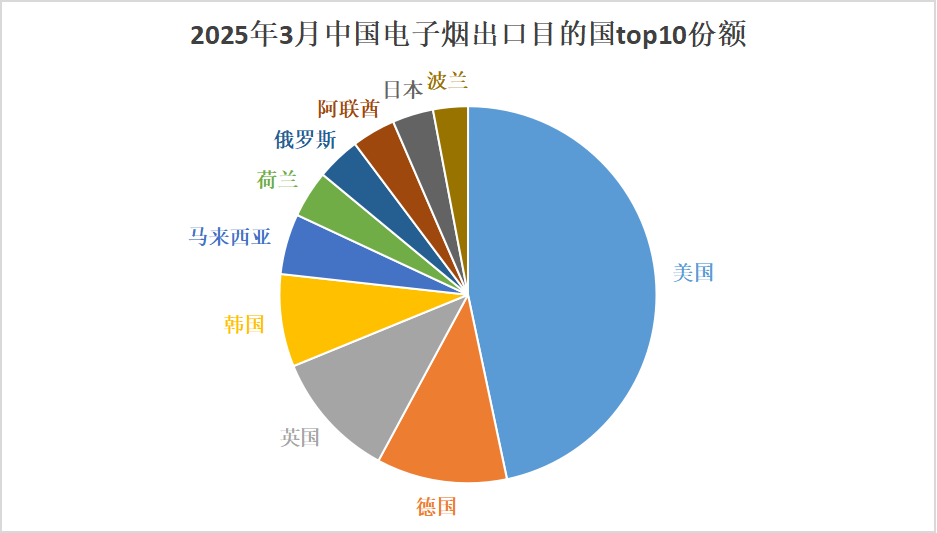

Top 10 Vape Export Destinations from China – March 2025

China’s top 10 export markets for E-cigarettes in March 2025 and their corresponding trade values are as follows:

| Rank | Country | Export Value (USD) | YoY Change |

|---|---|---|---|

| 1 | USA | $315,000,000 | +3.17% |

| 2 | Germany | $75,460,000 | +17.94% |

| 3 | United Kingdom | $73,870,000 | -14.87% |

| 4 | South Korea | $53,500,000 | +5.38% |

| 5 | Malaysia | $35,040,000 | +30.94% |

| 6 | Netherlands | $29,180,000 | +7.21% |

| 7 | Russia | $28,700,000 | +9.66% |

| 8 | UAE | $27,460,000 | +4.75% |

| 9 | Japan | $26,230,000 | -2.14% |

| 10 | Poland | $25,980,000 | +8.60% |

These figures highlight both the resilience and adaptability of China’s vape export market in the face of shifting global policies and market demands.

Market Trends: Fruit Flavored Vape Products Fuel Demand

One of the ongoing drivers of the global vape trade is the growing demand for fruit flavored vape products. These flavors — including mango, watermelon, strawberry, and lychee — are especially popular in Europe, Southeast Asia, and North America.

Consumer feedback and sales reports suggest that flavor variety plays a significant role in customer retention and acquisition. As a result, Chinese manufacturers continue to invest in flavor innovation, compact designs, and user-friendly disposable devices.

Additionally, the introduction of nicotine salts has further diversified the product landscape, allowing for smoother throat hits and higher nicotine concentrations without the harshness typically associated with freebase nicotine.

Regulatory Pressures and Tariffs: A Cloud Over the Market?

While March’s export data is optimistic, the future of China’s vape exports may face turbulence due to regulatory changes in key markets. Most notably:

- The U.S. has announced increased tariffs on a range of Chinese imports effective April 2025, including vape devices. Industry experts warn this could lead to price hikes and decreased competitiveness for Chinese brands.

- The U.K.’s disposable ban may significantly reduce export volumes unless Chinese manufacturers pivot to refillable and pod-based systems tailored to stricter guidelines.

- EU regulations on packaging, nicotine content, and flavoring could tighten further, especially with growing health concerns around youth vaping.

For many Chinese brands, diversification of markets and investment in regulatory compliance will be key strategies for long-term survival.

Opportunities in Emerging Vape Markets

Amid stricter rules in traditional markets, emerging economies are showing promising growth potential. Countries like Malaysia (with a 30.94% increase), Russia, and Poland are increasing their vapor imports, driven by local demand, evolving laws, and the rising popularity of fruit flavored vape devices.

Southeast Asia, in particular, offers favorable taxation policies, young demographics, and rising disposable incomes — ideal conditions for vape industry expansion.

Conclusion: Resilience and Innovation Drive China’s Vape Export Growth

China’s E-cigarette export industry has demonstrated impressive resilience and agility, even in the face of tightening international regulations and geopolitical uncertainty. The country’s continued leadership in the vapor product space owes much to its efficient supply chain, cost-effective manufacturing, and deep understanding of global market trends.

Looking ahead, adaptability will be the name of the game. From regulatory compliance and flavor innovation to smart market targeting and environmental considerations (like recyclable devices), China’s vape sector seems well-equipped to navigate the complex currents of the global market.

As March 2025’s export data reveals, while the clouds of regulation and tariffs may loom large, the vape industry’s momentum — driven by consumer interest in fruit flavored vape alternatives — shows no signs of dissipating.

Discover more from Ameca-mall

Subscribe to get the latest posts sent to your email.