The Evolution of Heat-Not-Burn (HNB) Technology: From Premier to Modern Fruit-Flavored Vape and E-Cigarette Innovations

Introduction

The vape, vapor, and e-cigarette industry has undergone significant transformations over the years, with fruit-flavored vape products gaining immense popularity. Among the most groundbreaking advancements is Heat-Not-Burn (HNB) technology, which offers a less harmful alternative to traditional smoking. This article explores the history of HNB, from its inception in 1988 to its modern-day innovations, while also examining how fruit-flavored vape and e-cigarette trends have shaped the industry.

1. The Beginning: The Birth of HNB Technology

The First HNB Product: Premier by Reynolds Tobacco (1988)

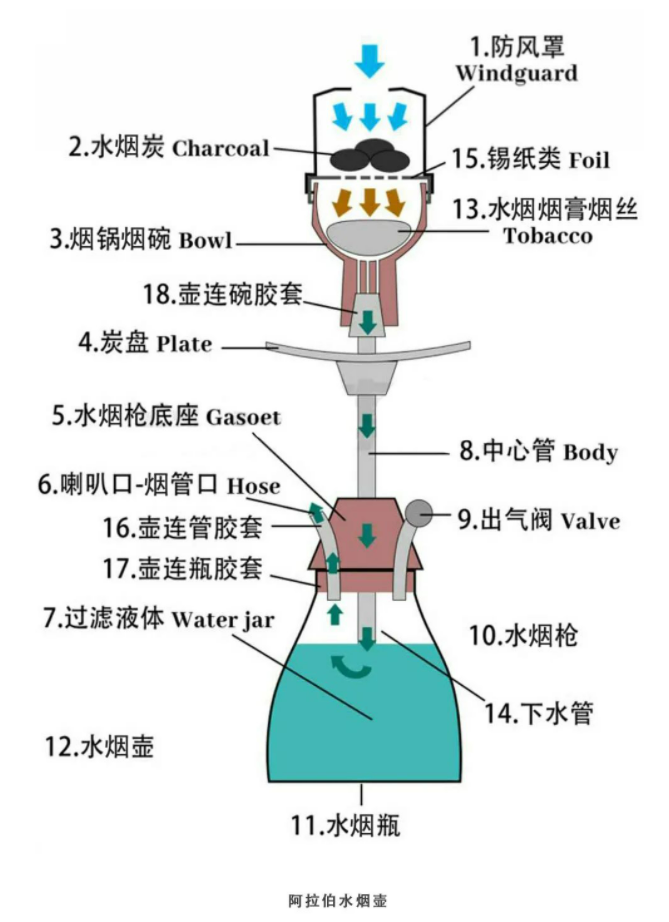

The world’s first Heat-Not-Burn (HNB) product, Premier, was introduced in 1988 by Reynolds Tobacco Company (RJR) in the United States. This revolutionary product was inspired by Arabic hookah (shisha), a centuries-old smoking method originating from India and popularized in the Middle East.

How Premier Worked:

- Carbon Heating System: Premier used a carbon tip that, when lit, generated heat.

- Tobacco Distillation: The heated air passed through a tobacco plug, releasing vapor without combustion.

- Reduced Harmful Chemicals: Since the tobacco didn’t burn, it produced fewer toxins than traditional cigarettes.

Why Premier Failed:

Despite its innovative approach, Premier faced poor market reception due to:

- Unpleasant taste and weak vapor production

- Inconsistent heating

- High cost compared to conventional cigarettes

Reynolds discontinued Premier but laid the foundation for future HNB developments.

2. The Rise of Modern HNB: Philip Morris International (PMI) and IQOS

Early Attempts: Accord (1998) & Heatbar (2007)

After Reynolds’ initial failure, Philip Morris International (PMI) entered the HNB market with:

- Accord (1998): An electric heating device that failed due to high vapor temperature and low smoke output.

- Heatbar (2007): Another unsuccessful attempt with similar issues.

The Breakthrough: IQOS (2014)

PMI invested over $3 billion and hired 400+ scientists to perfect HNB technology. In 2014, they launched IQOS in Nagoya, Japan, which became a massive success.

Why IQOS Succeeded Where Others Failed:

- Precise Temperature Control: IQOS heated tobacco at 350°C (vs. 600°C in combustion), reducing harmful chemicals.

- Strong Flavor & Satisfying Vapor: Unlike Premier, IQOS delivered a smooth, cigarette-like experience.

- Strategic Market Expansion: After Japan, IQOS expanded to the EU, Russia, South Korea, and beyond.

By 2016, IQOS dominated the HNB market, proving that electric heating was the future—not carbon-based systems.

3. The HNB Boom: Global Competition and Innovation

Big Tobacco’s Race for HNB Dominance

With IQOS’s success, other tobacco giants rushed into HNB:

British American Tobacco (BAT) – glo

- Launched glo in 2016, using a different heating mechanism to bypass PMI’s patents.

- Marketed as a smoother alternative to IQOS, with varying temperature settings.

Japan Tobacco International (JTI) – Ploom Tech

- Introduced Ploom Tech (later Ploom X), using hybrid vaporization (heating a liquid that passes through tobacco).

- Popular in Japan, competing directly with IQOS.

China’s Entry into HNB: Infrared Heating Technology

Chinese companies like China Tobacco entered the HNB market later but made rapid progress:

- Infrared Heating: Some Chinese HNB devices use infrared heating, which is more efficient than traditional coil systems.

- Domestic Market Focus: Due to strict regulations, most Chinese HNB products are sold domestically.

Challenges for Chinese HNB Brands:

- PMI’s Patent Dominance: IQOS holds thousands of patents, making it hard for competitors to innovate without legal risks.

- Consumer Preferences: Unlike Japan and Europe, China’s smoking culture still favors traditional cigarettes.

4. The Future of HNB and Its Impact on Vape & E-Cigarette Trends

HNB vs. Vape & E-Cigarettes

While HNB heats real tobacco, vapes and e-cigarettes use e-liquids, often with fruit-flavored vape options.

Key Differences:

| Feature | HNB (IQOS, glo) | E-Cigarettes/Vape |

|---|---|---|

| Heating Method | Heats tobacco sticks | Heats e-liquid (PG/VG) |

| Nicotine Source | Real tobacco | Synthetic nicotine/salts |

| Flavors | Tobacco-centric | Fruit-flavored vape, desserts, menthol |

| Health Impact | Fewer toxins than cigarettes | Varies (no combustion but concerns over additives) |

Will Fruit-Flavored Vape Overtake HNB?

- Youth Appeal: Fruit-flavored vape dominates among younger users due to sweet tastes and variety.

- Regulatory Pressures: Many countries ban flavored vapes, pushing users toward HNB.

- Tobacco Loyalists: Traditional smokers prefer HNB for its cigarette-like experience.

Innovations to Watch:

- Hybrid Devices: Combining HNB and vape tech (e.g., Ploom Tech’s liquid-to-tobacco system).

- Biodegradable HNB Sticks: Eco-friendly alternatives to traditional tobacco sticks.

- Smart HNB Devices: Bluetooth-enabled heating control for personalized sessions.

Conclusion: The Ongoing Evolution of Smoking Alternatives

The HNB industry has come a long way since Premier’s failure in 1988. Today, IQOS, glo, and Ploom dominate, while fruit-flavored vape products continue to attract a different audience. As technology advances, we may see more convergence between HNB and e-cigarettes, offering smokers safer, more enjoyable alternatives.

For vape sellers and e-cigarette entrepreneurs, staying updated on HNB trends is crucial, as these products could shape the future of nicotine consumption. Whether consumers prefer tobacco-rich HNB or sweet fruit-flavored vape, innovation will continue driving this dynamic industry forward.

Discover more from Ameca-mall

Subscribe to get the latest posts sent to your email.