UK Disposable Vape Ban’s First Week: £5.2M Sales Plunge, Black Market Fears Rise

LONDON, UK — The UK’s landmark ban on disposable vapes, enforced nationwide on June 1, 2025, has triggered a seismic £5.2 million weekly sales collapse in its debut week—exposing deep fractures in the legal vape market, alarming environmental gains, and igniting fears of a surging black market for fruit flavored vape products.

The Immediate Market Impact

- Revenue Freefall: Sales across 13,000+ UK stores (including convenience retailers and gas stations) plummeted from £23 million to £17.8 million weekly—a 22.6% drop—as disposable inventories vanished overnight17.

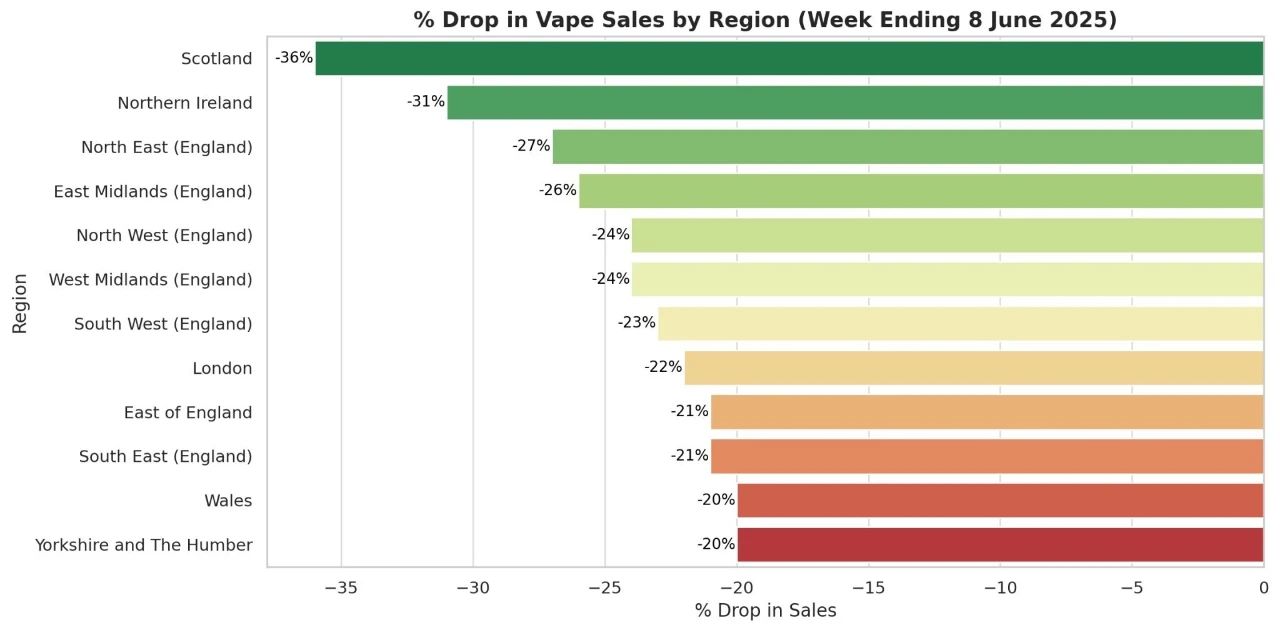

- Regional Disparities: Scotland absorbed the sharpest blow (-36%), while all regions saw declines exceeding 20%. This reflects uneven consumer adaptation to reusable alternatives like pod systems and open-tank e-cigarette devices1.

- Illicit Sales Surge: Despite the ban, over £1 million worth of disposable vape products were sold in early June, signaling widespread non-compliance. Retailers flouting regulations risk £200 fines (first offenses) or up to two years’ imprisonment for repeat violations.

Why the Ban? Youth, Environment, and Regulatory Backlash

The UK government’s prohibition targets two urgent crises:

- Youth Vaping Epidemic:

- 25% of 11–15-year-olds now use e-cigarette devices, lured by candy-like fruit flavored vape options and social media marketing.

- Disposable usage among minors surged ninefold in two years, forcing policymakers to prioritize nicotine addiction prevention.

- Environmental Catastrophe:

- The UK discarded 5 million disposable vape units weekly—each containing plastic, lithium, and heavy metals. The ban aims to slash vape-related e-waste by 80% and eliminate £200 million in annual recycling costs.

Industry Chain Reaction: From Retailers to Chinese Manufacturers

- Convenience Stores: Suffering £500,000+ daily losses, retailers scramble to clear inventories. Display bans now hide all vapor products from view.

- Chinese Export Collapse: As the UK’s second-largest vape supplier, China faces a 13.6% annual export drop (£12.19 billion in 2024). Brands like Elf Bar (owned by iMiracle) and SKE (owned by Scotle) dominated 66% of the UK disposable market—now scrambling to pivot to reusable devices.

- Investor Panic: Scotle’s parent company, Winholt Technology, saw shares nosedive 11.33% post-ban announcement. Smaller manufacturers face bankruptcy without rapid innovation.

The Black Market Threat and Consumer Shifts

Inadequate enforcement resources (£10 million allocated vs. £30.7 million needed) jeopardize the ban’s viability17. Consequences include:

- Illicit Trade: Border seizures of non-compliant disposables (often with untested fruit flavored vape liquids) are rising.

- Consumer Exodus: 11% of former disposable users switched to cigarettes or cross-border purchases—undermining public health gains.

- Reusable Device Limits: Open-system vapor sales are rising but can’t offset the £5.2 million revenue gap. Their higher cost and complexity deter former disposable users.

Global Domino Effect

The UK joins France, Australia, and New Zealand in banning disposables, while Germany and the EU weigh similar laws1214. The World Health Organization (WHO) endorses such bans to curb youth nicotine addiction globally.

The Road Ahead: Survival Strategies for a Reshaped Market

- Retail Adaptation: Specialist Vape Retailers (SVRs) must leverage their exclusive right to sell refillables but face draconian advertising bans (no social media promotions or discounts).

- Product Innovation: Manufacturers like iMiracle are racing to develop compliant, high-capacity pod devices with eco-designs (e.g., recyclable materials).

- Enforcement Critical: Tracking “rechargeable disposables”—a new grey-market product—requires urgent regulatory clarity.

Conclusion: A £5.2 Million Warning to the Global Vape Industry

The UK’s disposable vape ban has struck a brutal blow to retailers, manufacturers, and consumers in just seven days. While environmental and youth protection goals are laudable, the policy’s success hinges on crushing illicit trade and ensuring viable, appealing alternatives for adult smokers. For the e-cigarette industry, this is a wake-up call: innovate toward sustainability and compliance, or collapse. As reusable vapor devices and fruit flavored vape liquids remain legal in specialist shops, the market’s future now pivots on balancing regulation with harm reduction—a high-stakes experiment the world is watching closely.

Discover more from Ameca-mall

Subscribe to get the latest posts sent to your email.