US CBD Vape Company Blinc Group Files for Bankruptcy: Six Chinese E-Cigarette Firms Among Creditors

Keywords: Vape, Vapor, E-Cigarette, Fruit Flavored Vape, CBD Vape, Blinc Group Bankruptcy, Chinese Vape Companies

Introduction

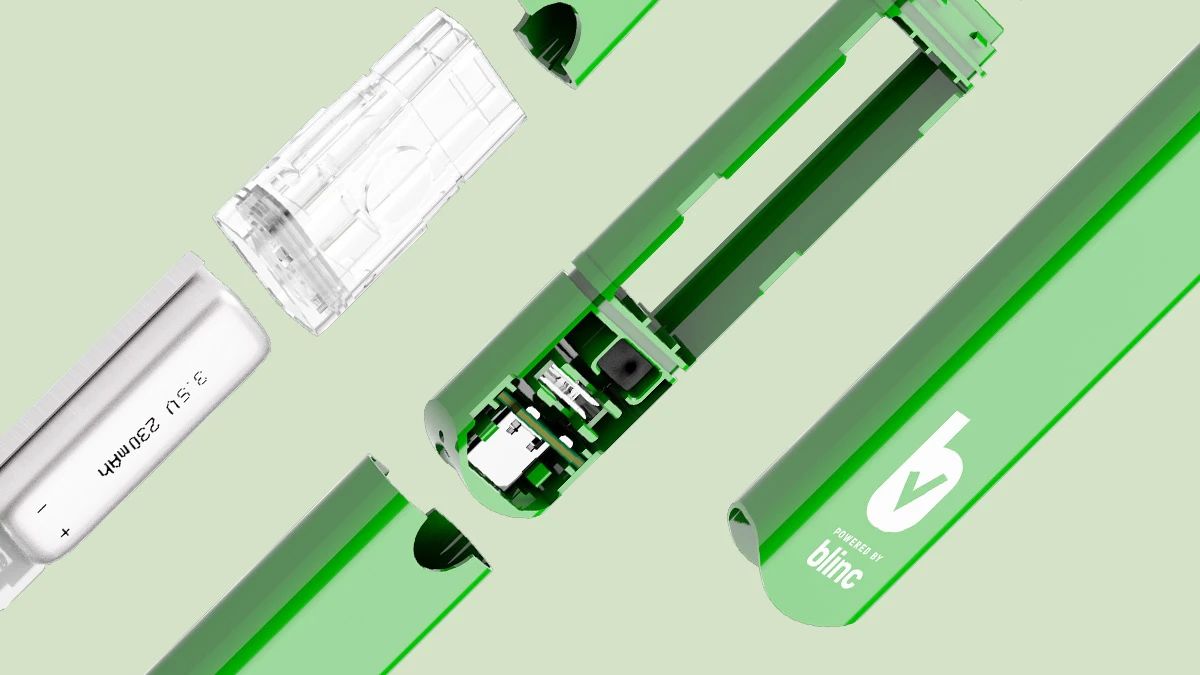

In a significant development for the global vape industry, Blinc Group Inc., a New York-based CBD vape company, has filed for Chapter 7 bankruptcy protection, listing liabilities exceeding $1 million. The company’s financial collapse has left numerous creditors unpaid, including six major Chinese e-cigarette manufacturers, tech giants like Microsoft and Google, and various service providers.

This article examines:

- Why Blinc Group filed for bankruptcy

- The full list of creditors, including key Chinese vape firms

- How this impacts the CBD and e-cigarette markets

- What this means for vape suppliers and international trade

Blinc Group Bankruptcy: Key Details

1. Chapter 7 Liquidation Filed in New York

- On March 14, 2024, Blinc Group CEO Arnaud Dumas de Rauly signed the bankruptcy petition.

- The company owes over $1 million to creditors, including unpaid taxes, vendor fees, and service charges.

- Under Chapter 7 bankruptcy, a trustee will liquidate Blinc’s assets to repay creditors.

2. Major Creditors Include Chinese Vape Manufacturers

Blinc Group’s creditor list reveals several prominent names, including:

✔ Tech Companies: Microsoft, Google (likely for cloud services/ads)

✔ Financial & Legal Firms: Tax authorities, law firms, consulting agencies

✔ CBD & Cannabis Companies: Unpaid partners in the cannabis industry

✔ Logistics & Media Firms: Shipping and PR agencies

Most notably, six Chinese vape companies are among the creditors:

- Shenzhen First Union Technology (合元)

- ICCPP (吉迩) & ICCPP Hong Kong Limited

- Shenzhen Itsuwa Technology (深圳五轮)

- Shenzhen JWEI Electronics (聚维)

- SMISS Technology (赛尔美)

- Shenzhen Boshang Technology (博上)

These firms likely supplied hardware, coils, or e-liquid components to Blinc Group.

Why Did Blinc Group Fail?

1. Financial Mismanagement & Unpaid Debts

- The company failed to pay taxes, vendors, and service providers for months.

- Despite launching a new product (TUUN) just last month, revenue was insufficient to cover liabilities.

2. Struggles in the US CBD Vape Market

- CBD vaping has faced regulatory hurdles and banking restrictions in the US.

- Many payment processors and advertisers (like Google/Facebook) block CBD-related businesses, making customer acquisition difficult.

3. Competition from THC & Nicotine Vapes

- In states where THC vapes are legal, CBD-only products struggle to compete.

- The rise of disposable nicotine vapes (like Elf Bar) further squeezed Blinc’s market share.

Impact on Chinese Vape Suppliers

1. Potential Losses for Shenzhen Manufacturers

- The six listed Chinese firms may face unrecovered debts, though exact amounts are undisclosed.

- Some may have to write off losses if Blinc’s assets don’t cover repayments.

2. Warning for OEM/ODM Partnerships

- Many Chinese vape companies operate as OEM suppliers for Western brands.

- Blinc’s collapse highlights the risks of extending credit to overseas clients.

3. Will This Affect Other US Vape Brands?

- Most large US e-cigarette companies (JUUL, NJOY) are financially stable.

- However, smaller CBD/THC vape brands could face similar cash flow issues.

The Future of CBD Vaping in the US

1. Tighter Regulations Ahead?

- The FDA still hasn’t approved most CBD vaping products.

- Banking and ad restrictions make profitability difficult.

2. Shift Toward Hemp-Derived THC Alternatives

- Some companies are pivoting to hemp-based Delta-8 or HHC vapes, which face fewer restrictions.

3. Will Chinese Suppliers Be More Cautious?

- Shenzhen manufacturers may tighten credit terms for US clients.

- Some may focus more on nicotine vaping, which has a larger global market.

Key Takeaways for the Vape Industry

✔ CBD vaping remains a risky market due to US regulations.

✔ Chinese suppliers should assess credit risks when dealing with foreign brands.

✔ THC and nicotine vapes dominate, while CBD struggles for mainstream adoption.

✔ Blinc’s collapse may signal further consolidation in the cannabis vape sector.

Conclusion: A Cautionary Tale for Vape Businesses

The bankruptcy of Blinc Group serves as a warning for both vape brands and suppliers. While the global e-cigarette market continues to grow, CBD vaping faces unique challenges—especially in the US.

For Chinese manufacturers, this case underscores the importance of financial due diligence when partnering with overseas companies. Meanwhile, US brands must navigate strict regulations and payment barriers to survive.

As the industry evolves, companies must adapt to shifting laws and consumer trends—or risk meeting the same fate as Blinc Group.

Discover more from Ameca-mall

Subscribe to get the latest posts sent to your email.