KT&G 2025 Q1 Financial Report: Diversified Development Trends in the Vape and E-Cigarette Industry

Industry

Introduction

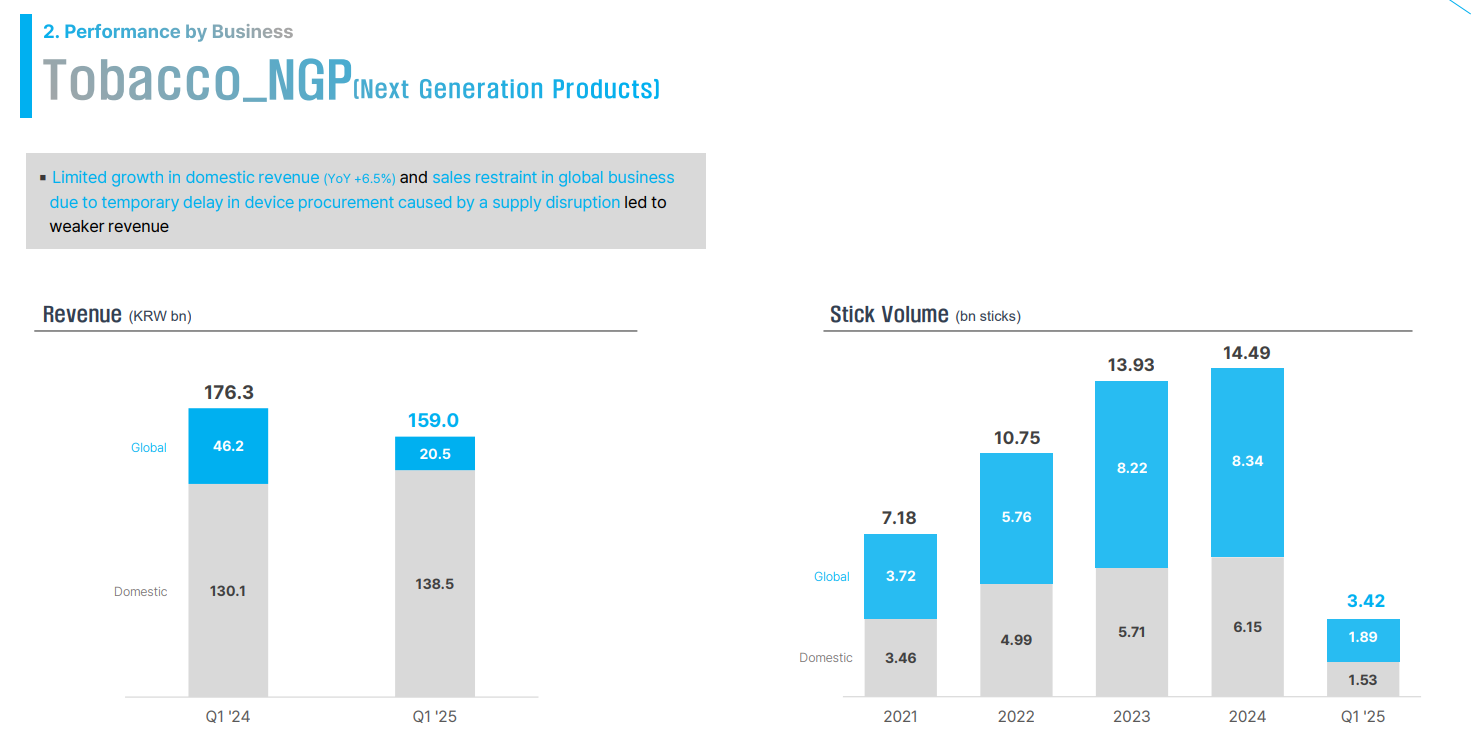

The global vape and e-cigarette industry continues to evolve, with manufacturers adapting to regulatory changes, consumer preferences, and supply chain challenges. Recently, KT&G, South Korea’s leading tobacco company, released its 2025 Q1 financial report, revealing significant trends in the Next-Generation Product (NGP) sector, including vapor devices, e-cigarettes, and fruit-flavored vape products.

The report highlights a divergence in performance between domestic and international markets, with strong growth in Korea but declines in global sales due to supply chain disruptions. This article will analyze KT&G’s financial results, market strategies, and future innovations, providing valuable insights for vape sellers, distributors, and industry stakeholders.

KT&G’s 2025 Q1 Financial Performance Overview

1. Domestic Market Growth Driven by Product Innovation & E-Commerce

KT&G’s Korean NGP division reported strong revenue growth, reaching 138.5 billion KRW (≈ $101 million USD), a 6.5% YoY increase. This growth was attributed to:

- Increased market penetration (up 1.8%) due to new product launches.

- Expansion of e-commerce channels (major platforms like Coupang, Naver, and 11st).

- Success of new brands such as Gidarim and GL-Pro, which strengthened KT&G’s leadership in the Korean vape market.

The company also focused on premiumization, with Lil Series heat-not-burn (HNB) products driving a 2.5% increase in average selling price (ASP).

2. Global NGP Sales Decline Due to Supply Chain Issues

In contrast to domestic success, global NGP sales dropped by 9.7% YoY, totaling 159 billion KRW (≈ $116 million USD). Key factors included:

- A 10.4% decline in unit sales (1.89 billion sticks) due to device supply shortages.

- Logistical challenges in emerging markets, affecting distribution.

- Regional variations:

- Middle East & Southeast Asia maintained growth through aggressive pricing strategies.

- Other emerging markets saw temporary declines due to shipping delays.

KT&G is addressing these issues by:

- Implementing emergency procurement measures to stabilize Q2 supply.

- Expanding local production in Indonesia to meet demand.

- Strengthening its “FILTER Plus” brand in key markets like Russia and Indonesia.

Key Trends in the Vape & E-Cigarette Industry

1. Rising Demand for Fruit-Flavored Vape Products

One of the most notable trends in the global vape market is the growing popularity of fruit-flavored e-liquids. Consumers, especially younger demographics, prefer sweet and exotic flavors over traditional tobacco tastes.

- Market Data: A 2024 report by ECigIntelligence (source) shows that fruit-flavored vapes account for over 60% of disposable e-cigarette sales in Western markets.

- Regulatory Impact: Despite flavor bans in some regions (e.g., the EU’s TPD restrictions), Asian and Middle Eastern markets continue to drive demand.

KT&G could capitalize on this trend by expanding its flavored vape offerings, particularly in Southeast Asia, where disposable vapes are booming.

2. Heat-Not-Burn (HNB) vs. E-Cigarettes: Market Differentiation

The competition between HNB products (like KT&G’s Lil Series) and traditional e-cigarettes is intensifying.

| Feature | HNB (Heat-Not-Burn) | E-Cigarettes (Vape Pens) |

|---|---|---|

| Technology | Heats tobacco sticks | Heats e-liquid (nicotine salt/freebase) |

| Flavor Options | Limited (tobacco-centric) | Wide range (fruit, dessert, menthol) |

| Regulatory Status | Less restricted in some markets | Facing flavor bans in EU/US |

| Consumer Base | Older smokers transitioning from cigarettes | Younger users preferring flavors |

KT&G’s strategy of focusing on HNB domestically while expanding vape products overseas aligns with these market dynamics.

3. Supply Chain & Manufacturing Adjustments

The global vape industry has faced supply chain disruptions since the COVID-19 pandemic, particularly in:

- Battery shortages (critical for vaping devices).

- Shipping delays affecting e-liquid and hardware imports.

KT&G’s response includes:

- Increasing production in Indonesia (target: 5.8 million devices in 2025).

- Diversifying suppliers to avoid future disruptions.

Future Outlook: KT&G’s 2025 Strategy

1. New Heating Device Launch (Late 2025)

KT&G plans to introduce a self-developed heating device, potentially competing with PMI’s IQOS and BAT’s Glo. This could:

- Reduce reliance on third-party suppliers.

- Boost profit margins by controlling the full production cycle.

2. E-Commerce & Direct-to-Consumer (DTC) Expansion

With online vape sales growing rapidly, KT&G is enhancing its digital strategy:

- Optimizing sales on Korean platforms (Coupang, Naver).

- Exploring DTC models in global markets.

3. Regulatory Adaptation

As vape regulations tighten worldwide, KT&G must:

- Comply with flavor restrictions in certain regions.

- Lobby for favorable policies in emerging markets.

Conclusion: What This Means for Vape Sellers

KT&G’s 2025 Q1 report highlights both challenges and opportunities in the vape, vapor, and e-cigarette industry. Key takeaways for independent sellers and distributors:

- Focus on fruit-flavored vapes in less regulated markets.

- Monitor HNB trends for premium product opportunities.

- Diversify suppliers to mitigate supply chain risks.

- Leverage e-commerce for direct sales growth.

For further insights, refer to KT&G’s official financial report (link) and industry analysis from ECigIntelligence (source).

Discover more from Ameca-mall

Subscribe to get the latest posts sent to your email.